In good times, banks love micro regulation because it creates barriers to entry and hence increases profits. Consequently, it is more influenced by economists. The institution is conceptually the smallest unit considered and it is interactions between institutions rather than their internal functions that are of most interest.

It is more supportive rather than retributive, being based on support for the financial system as a whole and the need to maintain its healthy operation at times and under circumstances when market forces do not on their own appear capable of achieving this. Implemented by lawyers and accountants, micro is essentially retributive. In both cases, conduct is regulated and sanctioned. In some circumstances, the legal person that is regulated is the institution and it takes responsibility for the behaviour of its employees or employees and the institution may both be regulated and share responsibility. Top-down and bottom-upĬlaudio Borio noted in 2003 that micro is bottom-up, with the focus on individual behaviour aggregated up to the level of the institution. Such fallacies of composition suggest that one cannot at all times achieve financial stability by the micro alone. Similarly, micro regulators would always see margining and margin calls as beneficial, while macro authorities might be concerned with the resulting forced selling and contagion. The resulting vicious feedback loop is a direct consequence of prudent self-preserving behaviour and amplified by harmonised micro prudential regulations.

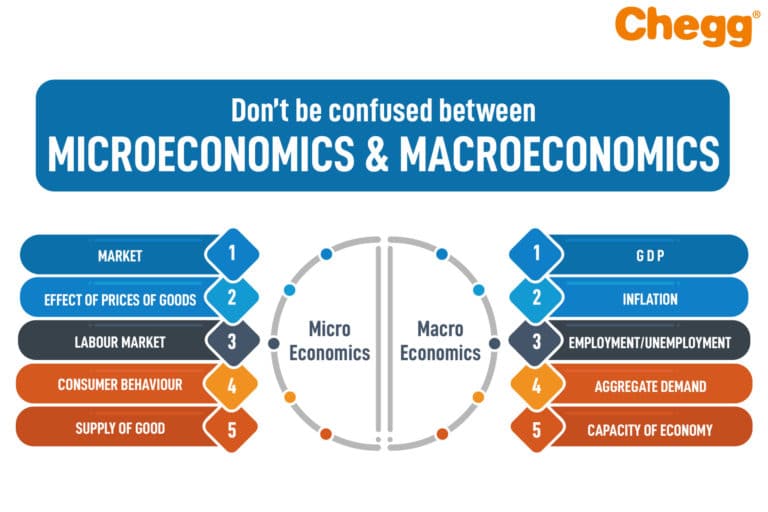

In a stress scenario, if prices start falling, prudent financial institutions will have no choice but to sell into a falling market, causing prices to drop more and spreading contagion. A macro regulator might counter by pointing that it is easy to construct models in which this is not true. Macro is focused on systemic risk and the stability of the entire financial system.Ī micro regulator might argue that as long as each institution is made to act prudently, the entire financial system is safe so therefore there is no need for macro. Micro is motivated by consumer and client protection, and aims to encourage confidence in banking services and hence to increase their use and consequently value to society. The potential for conflictīoth macro and micro serve the same ultimate policy objective of ensuring that the financial system provides the best service to the real economy, but in detail their objectives are quite different. However, while the ultimate objectives and implementation tools of macro and micro are closely aligned, their intermediate objectives are not, setting the scene for conflict. The limitations of both approaches became very clear during the Crisis and since then, macro has been a major part of financial policy. With the turning of the financial, economic and political cycles, their objectives will conflict more in coming years, leading to difficult turf battles.īefore the Crisis, financial policy was dominated by microprudential regulations, the implicit assumption being that a successful micro policy was sufficient to maintain the efficient operation of the financial system, just as a successful anti-inflation policy was all that was required from monetary policy. The objectives of macro- and microprudential policies have broadly coincided since the Global Crisis.

0 kommentar(er)

0 kommentar(er)